Buying a car with cash in 2024? This Will Help You!

Cash is king, right? That’s what everyone used to believe, but how true is it in 2024? This article covers how buying a car with cash has changed over time.

So, should you pay cash for a new car in 2024? Let’s find out. When deciding to purchase a new vehicle, one of the primary considerations that car buyers need to make is the choice between paying cash or finance.

Remember several factors before making your final decision, especially in 2024. Buying a car with cash might be more complex than people think. Here’s everything you need to know.

“Drive Past Myths: Get the Real Deal on Car Buying!”

🚘 Uncover 13 Car Buying Misconceptions with Our FREE Newsletter!

Plus you will get our quick tips, expert advice, and myth-busting insights delivered straight to your inbox.

Subscribe now and make informed decisions without the detours.

“Experts Hate This! Learn the Car Buying Secrets They Don’t Want You to Know. Free Subscription!”

Financing a car is much more common these days due to many factors. Car prices have increased considerably, and so have financing options. At the same time, the main drawback of buying a car with cash is that you must pay a substantial amount.

In general, even if your condition allows you to do so, buying a car with cash is not recommended. This article will tell you why.

Buying a car with cash in 2024

The main drawback of buying a car with cash in 2024 is paying a massive amount upfront. If your finances allow for this movement, and you’re not cash-strapped after the purchase, consider doing so.

Let’s weigh the pros and cons of buying a car with cash. First, let’s start with the positive.

Pros and cons of paying cash for a car

You spend what you can afford, and there are no surprises

When buying a car with cash, especially a new one, you will spend a determined amount only once. For example, let’s say you’re buying a $50,000 vehicle. Then, you show up at the dealership and pay for your car.

Now, there’s something we must clarify. Chances are you can’t show up with cash. Ideally, a dealership will take a wire transfer or cashier check.

That amount is final, but it might include one-time fees.

There are no interest payments.

When buying a car in cash, you’re not financing it. Instead, once the payment goes through, it’s yours. This means you won’t have to pay interest or monthly car payments.

If you don’t want a financial obligation every month, then this is the best option for you. After all, if you finance a $50,000 car, you could pay around $11,000 in interest over time.

You own the car

One significant benefit of buying a car with cash is that once you’ve paid, it’s yours. You don’t owe money to anyone, and there won’t be any monthly financial responsibilities.

With that being discussed, let’s look at the cons of buying a car with cash.

Cons of buying a car with cash

It can be financially limiting

While buying a car with cash avoids any monthly payments, it can create a financial burden. After all, you do have to part ways with $50,000 (in our example), which could severely impact your ability to pay for other things, especially in an emergency.

You don’t build a credit score

Buyers might not consider this one, but financing a car (and paying on time) is an excellent way to build a credit score, which is always necessary in today’s times. A solid credit history is crucial for other financial operations, such as mortgages and refinancing.

You might not be able to buy the car you want

One big downside of buying a car with cash is that it might limit your options. For example, you can pay $50,000, but your dream car might be worth $60,000, thus making it impossible to buy upfront.

Car dealerships throw in incentives with financing

While taking out a car loan or financing your vehicle might be daunting, it can also bring some benefits. Car dealers can include rebates and incentives or throw in an optional extra.

Repairs could be under your responsibility

New cars come with warranties but only cover 36,000 miles (for example) or two years. If you finance a car for four years, you could get extended coverage, which you won’t get if you buy the car upfront.

Given car prices and the current financial situation, buying a car or truck with cash could mean a heavy financial burden. So, if you plan to do so, perform a thorough analysis of your finances and possible short- and long-term outcomes.

Pros and Cons of Buying a New Car

Even if you pay for the car, this has advantages and disadvantages. While a new car offers the latest features, technology, and warranties, it also depreciates quickly in value compared to a used car. This is important to consider when deciding whether to pay in cash.

Buying a Used Car vs. Buying a New Car

When comparing buying a new or used car, buyers need to weigh the cost savings of a used car against the benefits of a brand-new vehicle. Used cars generally come at a lower price point, which can be more appealing when paying cash. In contrast, new cars provide the assurance of being the first owner.

Factors to Consider Before Purchasing a Vehicle

Before buying the car outright, it’s essential to consider various factors. These include your budget, the type of vehicle you need, your credit score if you plan to finance, and the ongoing costs of car ownership, such as insurance and maintenance.

Financing Options Vs Buying A Car With Cash

Finance a Car: Auto Loans Explained

Understanding auto loans is crucial for those who choose to finance a car. Auto loans involve borrowing money from a lender to purchase a vehicle, and the borrower repays the loan with interest over a specified period. This can be an attractive option for those who prefer to avoid paying the full amount in cash upfront.

Monthly Payments vs. Cash Payment

Car shopping can be daunting. So, when contemplating between monthly payments or a cash payment for a car, buyers should consider their financial situation and long-term goals. While cash payment eliminates interest costs and monthly obligations, financing may allow you to preserve cash flow and build credit through timely payments.

Interest Rates and Financing Deals in 2024

Interest rates and financing deals play a significant role in determining the overall cost of purchasing a car. In 2024, potential buyers should keep a close eye on interest rate trends and explore financing deals that could reduce the financial burden of acquiring a new vehicle.

Dealer Considerations

Choosing the Right Dealership

Deciding where to buy your car is as crucial as choosing the vehicle. Buyers should research and find reputable dealerships that offer fair prices, excellent customer service, and a range of car options to suit their needs.

Advantages of Paying Cash at the Dealer

Paying cash at the dealer can streamline the buying process and potentially lead to discounts or special offers. Cash transactions are straightforward and give buyers more negotiation power when finalizing the deal, only if you know when to negotiate.

Dealer Discounts and Negotiation Tips

Dealerships often provide discounts or incentives to cash buyers to encourage immediate purchases. Additionally, knowing effective negotiation strategies can help buyers secure a better price or additional perks when buying a brand-new or used car.

Car Pricing

Understanding Car Prices in 2024

With the constant flux in the automotive market, understanding car prices in 2024 is essential for making an informed decision. Factors such as demand, supply chain disruptions, and technological advancements can all impact the pricing of vehicles.

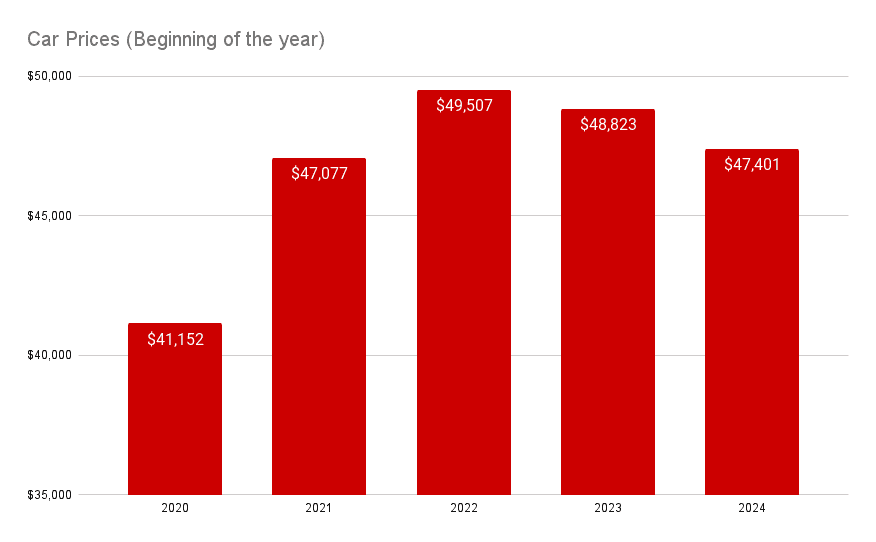

Since 2022, car prices have a crazy performance, as shown by the following image:

So, keeping a pulse on this and understanding how it has changed is essential for buying a new car. Sources such as Kelley Blue Book become crucial for those who buy cars. Used car prices have also changed considerably.

How to Get the Best Deal on a New Vehicle

Getting the best deal on a new vehicle involves thorough research, comparison shopping, and being open to negotiating with dealers. Buyers can increase their chances of securing a competitive deal by being informed about market prices and incentives.

Factors Affecting the Cost of a Car

Various factors influence the overall cost of a car purchase. These factors include the vehicle’s make and model, optional features, location, time of purchase, and the buyer’s negotiation skills. Being aware of these elements can help buyers make a more cost-effective decision.

Buying Strategies

Paying Cash vs. Financing a Car

Deciding between paying cash and financing a car depends on individual preferences and financial circumstances. While paying cash offers immediate ownership and savings on interest, financing provides flexibility and the opportunity to build a credit history.

When to Pay Cash for a Car Purchase

In particular situations, paying cash for a car purchase may be more advantageous. For instance, if you have a substantial amount of money available and wish to avoid debt, paying in cash could be the preferred option, especially if interest rates are high.

Tips for Buying a Car in 2024

For car shoppers in 2024, staying informed and being prepared are key to making a successful purchase. Research the latest car models, compare prices, explore financing options, and be ready to negotiate for the best deal possible. Remember, car buying is a significant investment, so making a well-thought-out decision is vital.

Closing thoughts on buying a car with cash

The decision between buying a car with cash and financing is nuanced, heavily dependent on personal financial circumstances and market conditions in 2024. The benefits of paying cash for a car, such as owning the vehicle outright and avoiding interest payments, present a compelling case for those who can afford the upfront cost without compromising their financial security.

This route offers a clear-cut transaction and immediate ownership, which can be especially appealing in a fluctuating economic climate.

However, the drawbacks of buying a car with cash, including the potential to strain one’s finances and limit vehicle options, must be considered. On the other hand, financing may offer the flexibility needed for many buyers, allowing for better cash flow management and opportunities to build credit despite the additional cost of interest.

The choice to finance can also open the door to higher-end models and the latest technologies that might otherwise be out of reach.

Ultimately, the key to making the right decision lies in a careful evaluation of one’s financial situation, the current car market in 2024, and long-term automotive needs.

Whether opting for the traditional appeal of buying a car with cash or leveraging the benefits of financing, the most important outcome is securing a deal that aligns with financial health and lifestyle requirements.