Is Buying A New SUV Worth It In 2024? The $156,000 Question!

If you knew it would cost over $150,000 to own and operate a new SUV, would you do it? This special issue explores the financial implications of buying a new SUV in 2024. Is it really a $156,000 Question? Let’s find out.

Our guide offers critical insights and an in-depth financial analysis to help you decide if buying a new SUV is the right move for you!

One of the biggest financial challenges families face right now is whether buying a new SUV or car at today’s prices is worth it. In recent years, car prices skyrocketed due to supply issues brought on by Covid shutdowns, chip shortages, and other production challenges.

Fast forward to today, and many of those supply imbalances are getting fixed. However, now, loan rates have doubled from just a few years ago, and the purchase price of vehicles are up 50% as well.

This raises the question, Is it worth buying a new SUV or car in 2024 or not?

Do you go deep into debt buying a new SUV or buy a used vehicle and accept you may have to pay for more repairs? In this article, we’re going to tackle these questions and more. I will share my experience and analysis with you so you can make an informed decision if you need a new vehicle.

Buying A New SUV: Personal Experience

My daughter turned 16 and needed a car to drive. With used car prices skyrocketing, I decided the best option was to let her drive my 12-year-old GX 460 SUV with 130k miles (I love that car), and I would buy a new Toyota Sequoia. In hindsight, I am second-guessing my decision to buy a new car.

I don’t regret my daughter driving the Lexus. It has been super reliable, and I believe it would protect her in an accident. I just don’t like that my new car payment is over $1,200 per month. It feels like that amount should be a house payment, not a car payment.

This got me wondering if I made a mistake buying a new SUV vs a used car. So, I did some analysis and want to share what I found with you.

Analysis Setup: Buying A New SUV vs Used For A Large Family

My family consists of two adults, two teenagers, and two dogs. We are constantly on the go, whether it’s driving carpool around town or the fact we are running up and down the interstate on most weekends.

As a result, this analysis will focus on purchasing a large SUV that can haul our family and all of our “stuff” wherever we want to go.

Let’s make this a reasonable comparison. I decided to analyze buying a 2019 GMC Yukon SLT vs a new 2024 Yukon SLT.

I picked this vehicle because it is popular, and my wife drives a 5-year-old 2019 GMC Yukon SLT with 55,000 miles, so I know the vehicle very well. I know its maintenance requirements and all of its quirks.

I searched local listings within 250 miles of my home and found list prices ranging from $37k to $45k. I believe you should be able to buy this vehicle for around $38,000, so that’s what we will use as the sale price.

For a new vehicle, I picked out a new 2024 GMC Yukon SLT with specs similar to my wife’s. It retails for $76,810 MSRP, but I used the car shopping tool from CarEdge.com (membership required and not a sponsor) and found a discounted sale price of $73,034 for a brand new GMC Yukon SLT, which is a 4.9% discount over MSRP.

Summary of Vehicles Used For Analysis:

- Used Vehicle: $38,000 – 2019 GMC Yukon SLT with 55k to 60k miles.

- New Vehicle: $73,034 – 2024 GMC Yukon SLT with 0 miles.

Next, I went through and did a fairly exhaustive comparison, and here is what that looks like:

New vs. Used Car Cost Comparison Table

| 2019 GMC Yukon SLT 4x4 | 2024 GMC Yukon SLT 4x4 | |

| MSRP | $58,995 | $76,810 |

| Sale Price Today | $38,000 | $73,034 |

| Discount % | 35.59% | 4.92% |

| Assumed Miles | 55,000 | 0 |

| Estimated Retail Price | $38,000 | $73,000 |

| Used vs New Difference (+/-) | -$35,000 | $0 |

| Loan Terms (Months) | 60 | 60 |

| Interest Rate | 7.34% | 6.84% |

| Down Payment / Trade In | $10,000 | $10,000 |

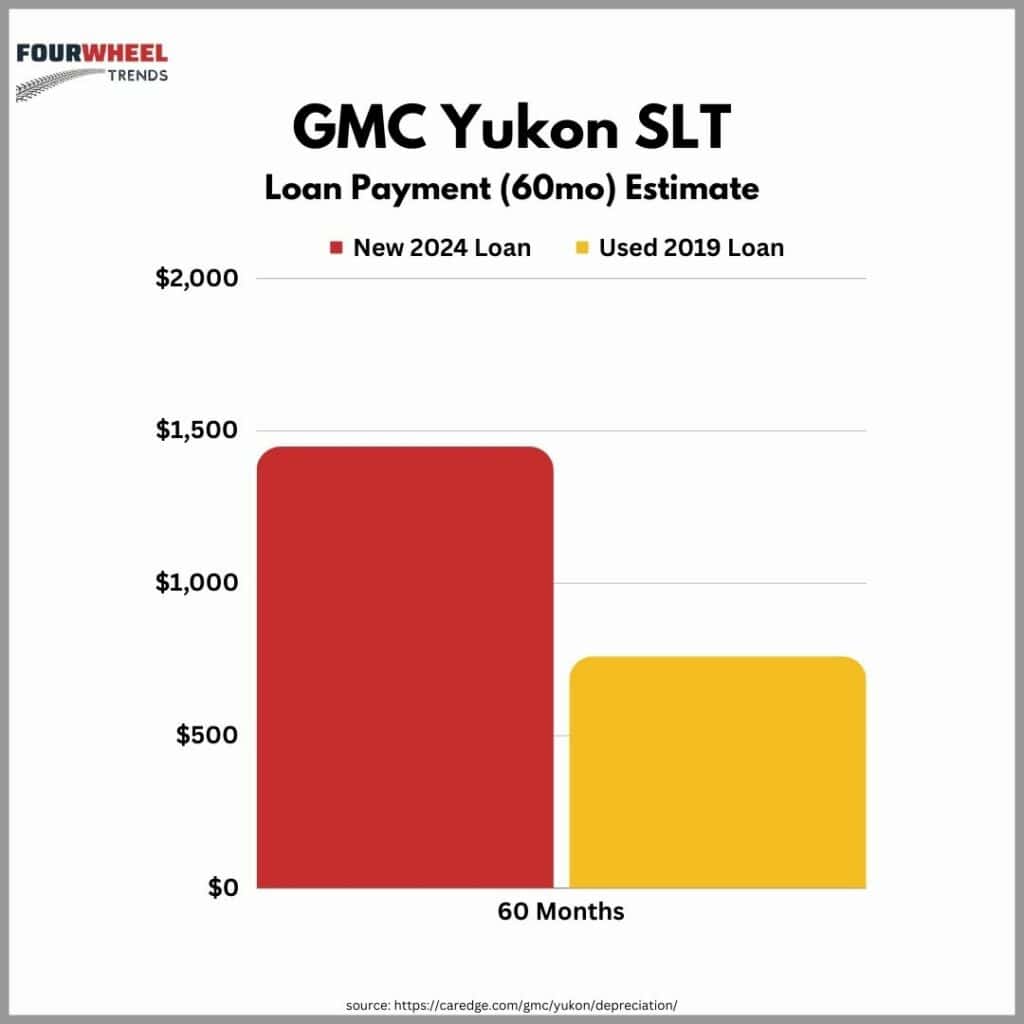

| Monthly Payment | $559 | $1,243 |

| Difference (+/-) | -$684 | $0 |

| Useful Vehicle Life (Years) | 12 | 12 |

| Current Age (Years) | 5 | 0 |

| Remaining Useful Life (Years) | 7 | 12 |

| Price Per Remaining Life (Years) | $5,429 | $6,083 |

| Difference (+/-) | -$655 | $0 |

| Insurance* | $883.19 | $957.91 |

| Difference (+/-) | -$75 | $0 |

| * 2019 insurance is actual price. 2024 is a quote for the same coverage. It should be noted that I have repair and replacement coverage which typically is only available when purchasing a new vehicle. | ||

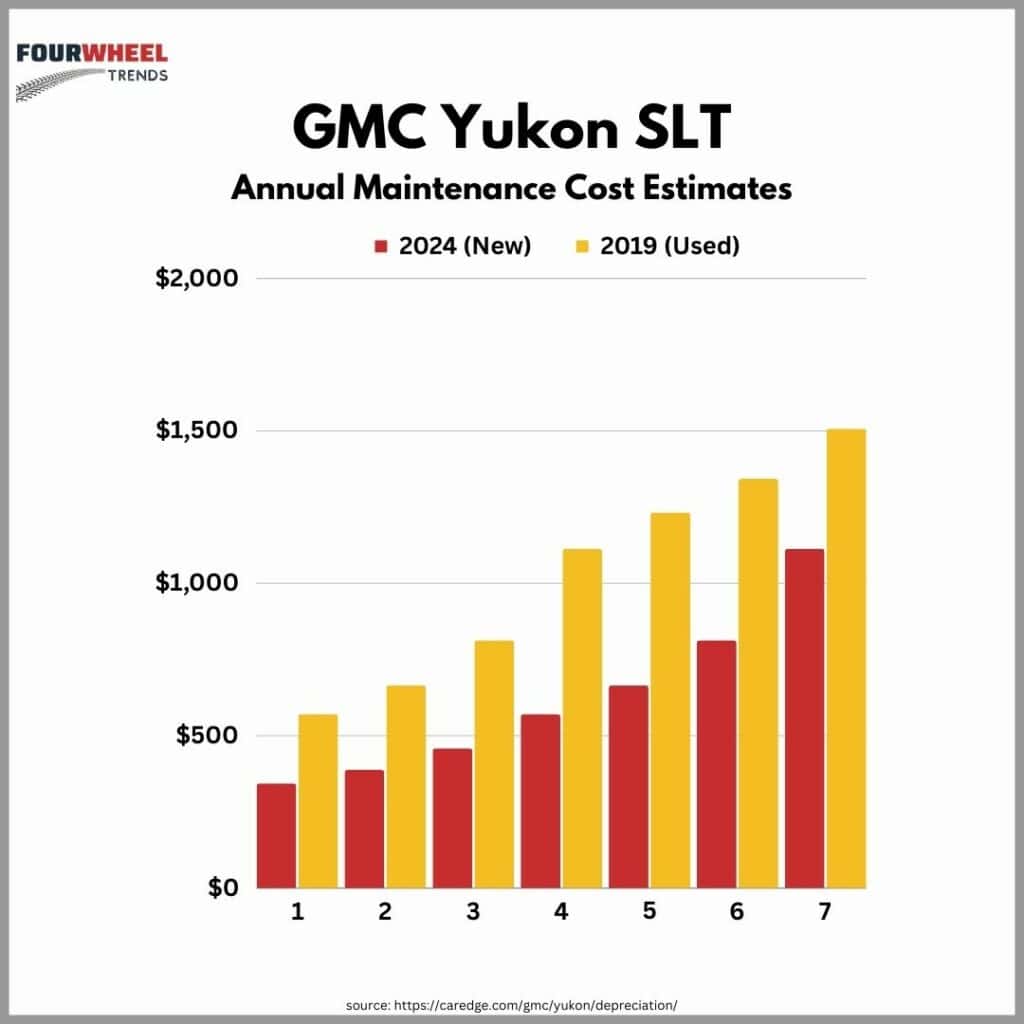

| Annual Maintenance Costs | New (7 years) | Used (7 Years) |

| Year 1 | $344 | $571 |

| Year 2 | $388 | $665 |

| Year 3 | $459 | $813 |

| Year 4 | $571 | $1,113 |

| Year 5 | $665 | $1,232 |

| Year 6 | $813 | $1,343 |

| Year 7 | $1,113 | $1,507 |

| TOTAL | $4,353 | $7,244 |

| 7 Years of Ownership | $11,943 | $23,115 |

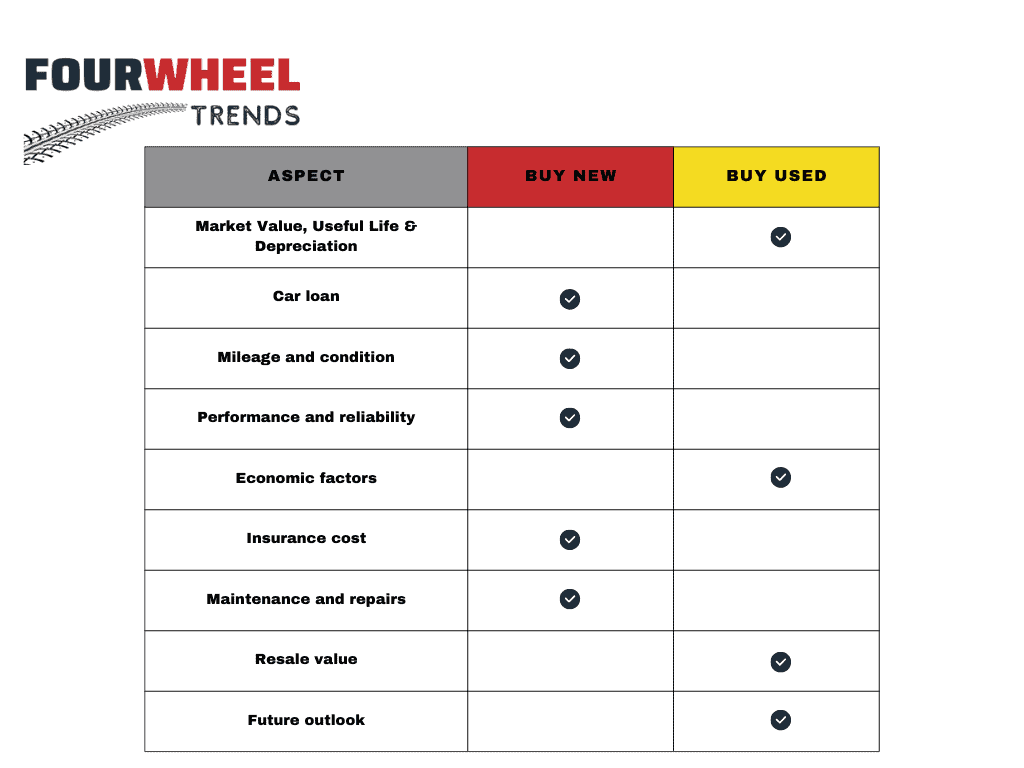

Analysis: Buying A New SUV Or Car vs Used In 2024

In these next several sections, I will break down my findings and thoughts regarding the pros and cons of buying a new SUV or car vs used vehicles in today’s market. These are some of the many considerations you must make when deciding what to buy for your family.

Market Value, Useful Life & Depreciation

We have all seen classic cars on the road today, and I must admit I also have one in my garage. However, it takes a tremendous amount of work, effort, and money to keep an old car on the road (classic or not).

Cars break down, and as components age, more and more problems need fixing on a car. Eventually, these repairs could cost more than the vehicle is worth.

This is the point when a vehicle typically gets put out of service and usually ends up being sold for parts. For our analysis, I will use the general rule of thumb that the lifetime usefulness of a vehicle is 12 years on average.

This means that after 12 years the vehicle has lost all value and is fully depreciated. Depreciation (going down in value) is one aspect of buying a vehicle that is in favor of used cars vs buying new.

As a buyer, you see the biggest drop in value is typically years 1 and 2. That’s when a new car buyer takes the biggest drop in value (depreciation).

Other than the last few crazy COVID years, vehicles typically depreciate in value each year they are in service. This is because you are using up the useful life of the vehicle.

This chart from CarEdge data shows how buying a car that is just a few years old would result in paying 80% less than a new car, yet you still have 83% of the vehicle’s useful life still remaining.

Winner: Buy Used – Too much depreciation happens when you drive the car off the lot. Buying used is the better deal when factoring in depreciation and the useful life of a vehicle.

Car Loan (Interest Rates)

With interest rates having doubled in recent years few years, my finding of this analysis may shock some people. While the car payment on the used vehicle was $684 less per month, the difference between a 6.84% new car loan and a 7.34% used car loan is shockingly only $14.88 per month! This is key when buying a new SUV or car.

I fould this surprising because we have been conditioned to seek out the lowest car loan rate possible. I would say this just further proves the biggest impact on what you pay is the price, not necessarily the interest rate.

Winner: Buy New – When it comes to loans, new cars get better rates. This said, we were not discussing price, only loans and that’s why buying new results in a lower car loan rate.

Mileage and Vehicle Condition

One of the harder ones to objectively analyze is vehicle condition and mileage. When buying a new SUV or car, you know exactly what you are getting. Any issues are covered under the initial warranty, and if something causes wear and tear on the vehicle, you are the one doing it.

On the other hand, as a used car buyer, someone else has already dealt with the new car issues and getting factory warranty work done. You have the advantage of shopping around to find that ulta clean low mile used car.

Winner: Buy New – There are so many subjective factors when evaluating condition and miles, so that’s why I picked new as the winner.

Performance and Reliablity

For many years, newer models promised greater performance and reliability. This was especially true going from the 80’s to the 90’s for reliability and then performance gains happened often from the 90’s to the 2000’s.

However, in recent years, we have seen factors like fuel economy, emissions standards, and advanced electronics play a bigger role in the evolution of cars.

It’s hard to say that performance or reliability has meaningfully improved with a new 2024 vehicle over a 2019 vehicle. Yes, there are really nice new features like adaptive cruise which is a game changer on long road trips, or big 14” screens.

However, a vehicle has so many computers and tech that it means more features to break. Therefore, I would argue that it is too early to say which vehicle would be more reliable if you are buying a 4-5 year old used vehicle with under 60k miles.

At least from our experience, we’ve only had two repairs outside of routine maintenance done on our 2019 Yukon. One of those was simply caused by a loose battery cable where the mechanic forgot to tighten down the battery cable after doing some work.

Winner: Buy New – If we are talking GMC Yukon specifically because they maintain the same reliable V8 motors and make transmission and other upgrades, new probably wins.

Additional Thoughts: In general, automakers might be getting more performance numbers, but they could be introducing more reliability issues. I am specifically thinking of my Toyota Sequoia. Gen 1 and 2 Sequoia’s used the million mile ultra reliable V8 and now it uses a hybrid gas-electric V6 with twin turbos. Even though Toyota is known for reliability, turbos are especially known to have frequent issues.

Economic Factors

Probably the single most stressful aspect of buying a car outside of deciding what to get, is paying for it. With new car prices today, you are paying for a car loan, an amount that just a few years ago was equal to rent payments for an apartment or payments on a home mortgage.

When looking at economic factors impacting buying a new SUV vs buying a used one, we must look at the purchase price. However, we also must look at the long-term costs associated with repairs, insurance, and everything else required to keep a vehicle on the road.

Using the factors from our table above, I have created a new calculation called “Price Per Remaining Life.” (If you can think of a better name for it, let me know in the comment section below!) This new indicator takes the remaining projected useful life of the vehicle divided by the sale price.

This way, we know how much value we are using per year of ownership.

Here is how these two vehicles compare:

Our analysis gives us what I call “Price Per Remaining Life” (see table above).

- The Used Yukon has a Price Per Remaining Life (PPRL) of $5,429

- The new Yukon has a Price Per Remaining Life (PPRL) of $6,083

Factor in car payments:

- Used = $559 x 12 months = $6708 x 7 yr = $46,963

- New = $1,243 x 12 months = $11,943 x 7 yr = $54,524

- Then Factor In Car Insurance:

- Used = $883.19 x 7 yr = $6,182.33

- New = $957.91 x7 yr = $6,705.73

Finally we factor everything together and we get:

- Used = $114,263.33

- New = $165,641.73

Winner: Buy Used – Between a lower Price Per Remaining life, and 31% lower overall economic costs, I conclude buying used is best from an economic factor.

Insurance Cost

I found the cost of insuring a 5-year-old used car to be quite surprising compared to the cost of insuring a brand-new vehicle.

I called my long-time friend and insurance agent, Dale Rimmer, over at Rimmer Insurance and told him about this article.

Dale and Emmalee were very helpful in pulling this information together for us. For the used Yukon, it was easy because we just pulled the data from my insurance bill.

Then, Emmalee ran a quote for adding a 2024 Yukon to my account and got a quote of $957.91. This price includes what is known as repair and replacement coverage.

Auto Owners Insurance describes repair and replacement coverage as: Provides Replacement Cost instead of Actual Cash Value for autos not more than 5 years old if it is determined that the vehicle is a total loss. Coverage is available for newly-titled autos. Positive verification of this coverage from a prior policy is required if the item is not newly-titled.

They pointed out that getting repair and replacement coverage is typically only available on new vehicles. If I were to remove the repair and replacement coverage, it would reduce the cost of insurance on the new vehicle down to $887.91 per year.

This is only $74 more than insurance on the 5-year-old Yukon. I have to admit I found it very surprising that the cost would be so similar.

Car Insurance:

Used = $883.19 x 7 yr = $6,182.33

New = $957.91 x7 yr = $6,705.73

Winner: New Car – Yes, it’s a little bit cheaper to insure the 5-year-old car, but you get repair and replacement coverage for that added bit of cost. That is a big deal if you were to total your vehicle. Their insurance would cover the purchase of a new vehicle. Without it, you would get a depreciated value.

Maintenance and Repairs

When evaluating the maintenance and repair costs of a new vs. used vehicle, it’s pretty obvious which vehicle should have lower repair costs. Between car warranties and all parts being new, a new car should be much less expensive to maintain.

From this chart, you can see it is clearly cheaper to maintain a new vehicle over a used one. In fact, according to the data from CarEdge, it is 50% less expensive.

Over a seven year period a new car requires $11,943 of maintenance while the 5 year old used vehicle requires $23,115 over the same seven year time frame.

Winner: New Car – In isolation, maintenance on a used vehicle obviously is going to be more expensive. However, when you add it to a greatly reduced selling price, paying the added maintenance costs is still quite compelling towards buying a used vehicle.

Resale Value

In our analysis, we assumed 12 years was the useful life. We then assumed purchasing a 5-year-old vehicle and owning it for seven years. This would put us at the 12-year mark, where we have an assumed $0 value.

In reality, there is still life left for these vehicles. I did a little calculating, and here is what I found.

I assumed 15,000 miles per year x 12 years to get 180,000 miles on a 12-year-old Yukon. This would put us in a 2012 model.

Using CarEdge, I looked up used 2012 Yukons with 170,000 – 200,000 miles and found that these vehicles range from $9,500 on the low end to $14,500 on the higher end.

I then looked up seven year old (2017) Yukons with 100,000 to 115,000 miles and found prices of $23,500 to $28,900.

Resale Value (Based on current market rates)

- 12 Year Old Yukon = $11,000

- 7 Year Old Yukon = $25,000

To determine the better resale value, we need to compare the resale value vs the sale price.

Purchase Price minus Resale Value:

- Used: $38,000 – $11,000 = $27,000 (depreciation)

- New: $73,000 – $25,000 = $48,000 (depreciation)

Winner: Buy Used – Resale value in relation to what you must pay for the vehicle shows that buying used is the clear winner.

Future Outlook

In economics, it is often said, the best cure for high prices is high prices.

With sky high prices, it will keep buyers of new cars out of the market and force dealerships and manufacturers to drop prices.

I believe this scenario will impact the new car pricing structure the most. Manufacturers will start offering dealers incentives to get vehicle sold and this will bring prices down.

I believe used car prices are not going to fall as much. They will come down some, but families who normally would buy a new vehicle are likely to trade down to a used one to help fit their budget.

Additionally, there will continue to be a reduced supply of quality used vehicles. The big challenge for the used market is the new market.

When someone buys a new car, they trade in their used vehicle. These used vehicles then go to auction, and that is how a used car dealer gets their inventory.

Winner: Buy Used – All of this combined leads me to think used cars are going to hold their value longer than buying a new car today. This said, if dealers start aggressively dropping prices, the case for buying new will become much more compelling.

Conclusion & Final Thoughts

Here we are, we’ve gone through a lot of details and numbers. Now we need to pull it all together and decide which is better. So, is buying a new SUV in 2024 worth it?

At the end of our analysis, the final results are 5 “Buy New” and 4 “Buy Used”.

As a result, buying a new SUV or car gets the slightest edge over buying a used one. Maybe this is why I feel so conflicted about buying a new vehicle.

If I were truly in love with the Toyota Sequoia the way I was with my 2012 Lexus GX 460, maybe I would not be so conflicted in my decision.

If you are curious about what I like and don’t like about the new Sequoia, be sure to sign up for our newsletter and I will soon put out a long term review of the vehicle now that I have owned it for a full 12+ months.